How the FEIE Standard Deduction relates to IRS Form 2555

Understanding the Foreign Earned Earnings Exemption and Its Effect On Your Conventional Deduction

The Foreign Earned Income Exemption (FEIE) offers considerable benefits for expatriates, permitting them to leave out a part of their foreign-earned revenue from U.S. tax. Declaring the FEIE can complicate one's tax obligation circumstance, especially relating to the typical deduction. Understanding this communication is crucial for people living abroad. As expatriates browse these complexities, they have to take into consideration how their options affect their overall tax obligation obligation. What approaches can they utilize to enhance their monetary outcomes?

What Is the Foreign Earned Earnings Exemption (FEIE)?

The Foreign Earned Revenue Exclusion (FEIE) functions as an essential tax advantage for U.S. residents and resident aliens functioning abroad. This provision enables eligible individuals to exclude a substantial section of their foreign-earned earnings from U.S. taxation, efficiently lowering their total tax worry. The FEIE aims to reduce the financial stress on migrants and encourages Americans to pursue job opportunity in foreign markets. The exclusion relates to incomes, incomes, and specialist charges made while residing in a foreign country. The optimal exclusion quantity is changed every year for rising cost of living, guaranteeing that it stays appropriate to current economic problems. By utilizing the FEIE, expatriates can keep more of their revenue, cultivating economic security while living overseas. On the whole, the FEIE plays an essential function in forming the monetary landscape for Americans abroad, assisting in a smoother shift to worldwide workplace and advertising financial engagement on an international scale.

Eligibility Requirements for the FEIE

Eligibility for the Foreign Earned Revenue Exemption (FEIE) is contingent upon conference particular criteria set by the Irs (IRS) Primarily, individuals have to be united state citizens or resident aliens that earn income while living in a foreign country. To qualify, they must satisfy one of two primary tests: the Physical Existence Test or the Authentic Residence Test.

The Physical Presence Examination requires individuals to be physically existing in an international country for a minimum of 330 full days within a 12-month period - FEIE Standard Deduction. Alternatively, the Authentic House Test demands that people develop residency in an international nation for a continuous duration that consists of an entire tax year

In addition, the income needs to be stemmed from personal services executed in the international nation. Satisfying these needs enables taxpayers to omit a considerable part of their foreign-earned earnings from united state taxes, consequently minimizing their total tax obligation.

Exactly how to Declare the FEIE

To begin the procedure, people must gather records that verify their international incomes, such as pay stubs, tax obligation returns from international nations, and any kind of pertinent employment agreement. It is vital to guarantee all earnings claimed under the FEIE is gained from international resources and satisfies the called for limits.

Furthermore, taxpayers should think about filing target dates and any kind of possible extensions. Asserting the FEIE appropriately not just helps in decreasing tax obligation responsibility but also guarantees compliance with internal revenue service laws. Appropriate paperwork and adherence to guidelines are vital for a successful case of the Foreign Earned Income Exemption.

The Communication In Between FEIE and Common Deduction

The communication in between the Foreign Earned Income Exclusion (FEIE) and the typical deduction is a crucial facet of tax obligation planning for expatriates. Understanding the basic principles of FEIE, in addition to the constraints of the common deduction, can considerably affect tax obligation declaring strategies. This area will discover these aspects and their ramifications for taxpayers living abroad.

FEIE Essentials Discussed

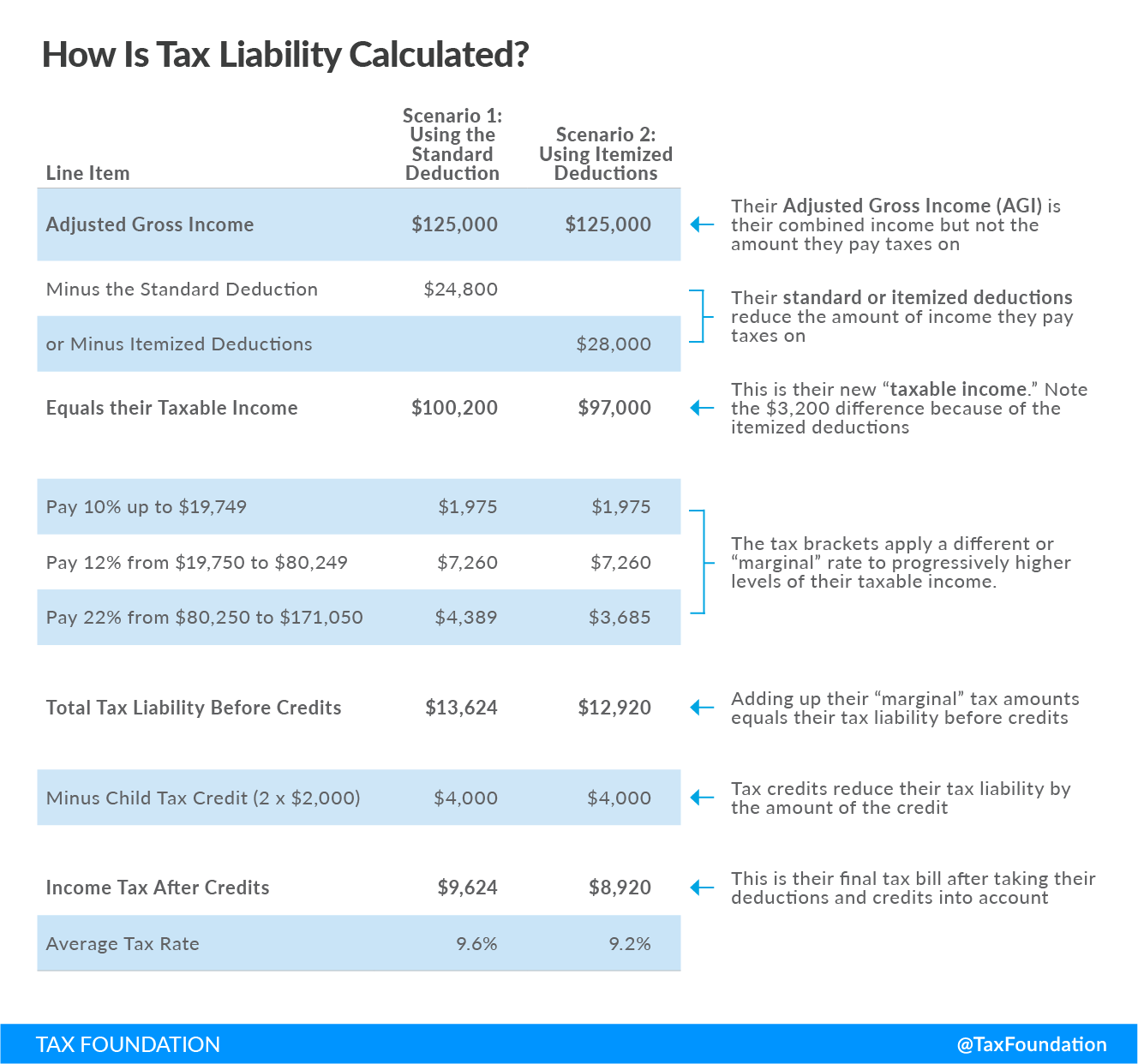

While lots of expatriates seek to reduce their tax worry, comprehending the communication in between the Foreign Earned Revenue Exclusion (FEIE) and the typical reduction is crucial. The FEIE allows united state citizens and resident aliens living abroad to omit a particular amount of foreign gained revenue from united state tax. This exclusion can significantly reduce gross income, possibly impacting eligibility for various other deductions, such as the conventional reduction. Extremely, individuals who assert the FEIE can not likewise take the typical reduction versus the excluded earnings. Therefore, expatriates should carefully evaluate their total revenue and deductions to maximize their tax obligation scenario. Understanding of these interactions can cause more informed monetary decisions and far better tax techniques for migrants guiding through their special conditions.

Standard Deduction Limitations

Recognizing the restrictions of the basic deduction in regard to the Foreign Earned Earnings Exemption (FEIE) is essential for migrants maneuvering their tax obligation duties. While the FEIE permits certifying individuals to exclude a certain quantity of foreign-earned income from united state taxes, it can affect the typical deduction they are qualified to case. Particularly, taxpayers that assert the FEIE can not additionally assert the basic reduction on that particular excluded income. Furthermore, if a migrant's complete income drops below the common reduction limit, they may not gain from it whatsoever. This interplay demands careful planning to maximize tax benefits, as underutilizing the typical deduction can lead to higher gross income and boosted tax obligation obligation. Recognizing these constraints is important for effective check out here tax obligation strategy.

Tax Obligation Declaring Implications

Steering the tax filing effects of the Foreign Earned Revenue Exemption (FEIE) needs cautious factor to consider of how it engages with the conventional deduction. Taxpayers using the FEIE can exclude a considerable portion of their foreign-earned revenue, but this exemption influences their qualification for the basic reduction. Especially, if an individual claims the FEIE, they can not additionally claim the standard reduction for that income. This can result in a lower general tax liability however might complicate the declaring procedure. Furthermore, taxpayers must assure conformity with internal revenue service needs when filing Kind 2555 for the FEIE. Understanding these interactions is essential for enhancing tax benefits while preventing potential pitfalls in the filing procedure. Mindful planning can make the most of advantages and reduce liabilities.

Possible Tax Ramifications of Making Use Of the FEIE

The Foreign Earned Earnings Exclusion (FEIE) supplies significant tax advantages for united state citizens functioning abroad, yet it likewise includes prospective ramifications that require cautious factor to consider. One major effect is the influence on qualification for specific tax obligation debts and deductions. By electing to use the FEIE, taxpayers might accidentally minimize their adjusted gross earnings, which can restrict access to credit histories like the Earned Income Tax Debt or decrease the amount of typical reduction available.

Additionally, people that make use of the FEIE might deal with complications when returning to the U.S. tax system, particularly concerning the taxes of future earnings. The exclusion uses just to earned revenue, suggesting other income kinds, such as returns or interest, remain taxable. This distinction requires thorough record-keeping to guarantee conformity. The FEIE might impact state tax obligation obligations, as some states do not acknowledge the exclusion and might tax all revenue earned by their residents, no matter of where it is made.

Tips for Maximizing Your Tax Benefits While Abroad

While functioning abroad can be enhancing, it additionally presents unique chances to maximize tax advantages. To optimize these advantages, people need to initially determine their qualification for the Foreign Earned Revenue Exemption (FEIE) and think about the physical existence examination or the authentic house examination. Maintaining in-depth records of all income made and expenditures incurred while overseas is necessary. This documentation sustains insurance claims for credit scores try here and reductions.

Additionally, recognizing the tax treaties between the United States and the host country can assist stay clear of dual taxes. Individuals should also discover this info here discover payments to tax-advantaged accounts, such as Individual retirement accounts, which might offer further reductions.

Lastly, seeking advice from a tax obligation specialist focusing on expatriate tax regulation can supply customized strategies and warranty conformity with both U.S. and international tax commitments. By taking these actions, migrants can effectively improve their economic circumstance while living abroad.

Often Asked Inquiries

Can I Utilize FEIE if I Help a Foreign Government?

Yes, a person can use the Foreign Earned Earnings Exclusion (FEIE) while benefiting an international federal government, offered they satisfy the requisite conditions outlined by the internal revenue service, consisting of the physical existence or bona fide house tests.

Does FEIE Relate To Self-Employment Income?

The Foreign Earned Earnings Exemption (FEIE) does use to self-employment earnings, offered the specific satisfies the essential demands. Qualified independent people can leave out certifying revenue made while residing in an international country from taxes.

Suppose My Foreign Revenue Surpasses the FEIE Restriction?

If international earnings surpasses the FEIE limitation, the excess amount might go through united state taxes. Taxpayers must report and pay taxes on the income over the exclusion threshold while still profiting from the exclusion.

Can I Claim the FEIE and Detail Reductions?

Yes, individuals can declare the Foreign Earned Earnings Exclusion (FEIE) while also itemizing reductions. They need to be aware that claiming the FEIE might impact the availability of specific itemized reductions on their tax return.

Just How Does FEIE Influence My State Tax Commitments?

The Foreign Earned Earnings Exclusion can minimize state tax commitments, as many states comply with federal standards. Individual state guidelines differ, so it's vital to seek advice from state tax obligation laws for particular effects on tax obligation obligations.

The Foreign Earned Revenue Exemption (FEIE) uses substantial advantages for migrants, permitting them to leave out a section of their foreign-earned income from United state tax. While several migrants look for to lower their tax obligation concern, understanding the communication between the Foreign Earned Revenue Exclusion (FEIE) and the basic reduction is crucial. Understanding the restrictions of the standard deduction in relationship to the Foreign Earned Revenue Exemption (FEIE) is vital for migrants navigating their tax duties. The exclusion uses only to earned earnings, meaning various other revenue kinds, such as dividends or interest, stay taxable. The Foreign Earned Earnings Exemption (FEIE) does apply to self-employment earnings, supplied the specific meets the required needs.